King County Real Estate Market Remains Robust

Introduction

The King County real estate market continues to be a tight seller’s market. This report for October 2023 provides key indicators of property values and market indicators for residences and condominiums, including the ever-important inventory levels (the number of months it would take to sell all the homes currently on the market). Also included is discussion on mortgage rates, which have a considerable impact on real estate sales.

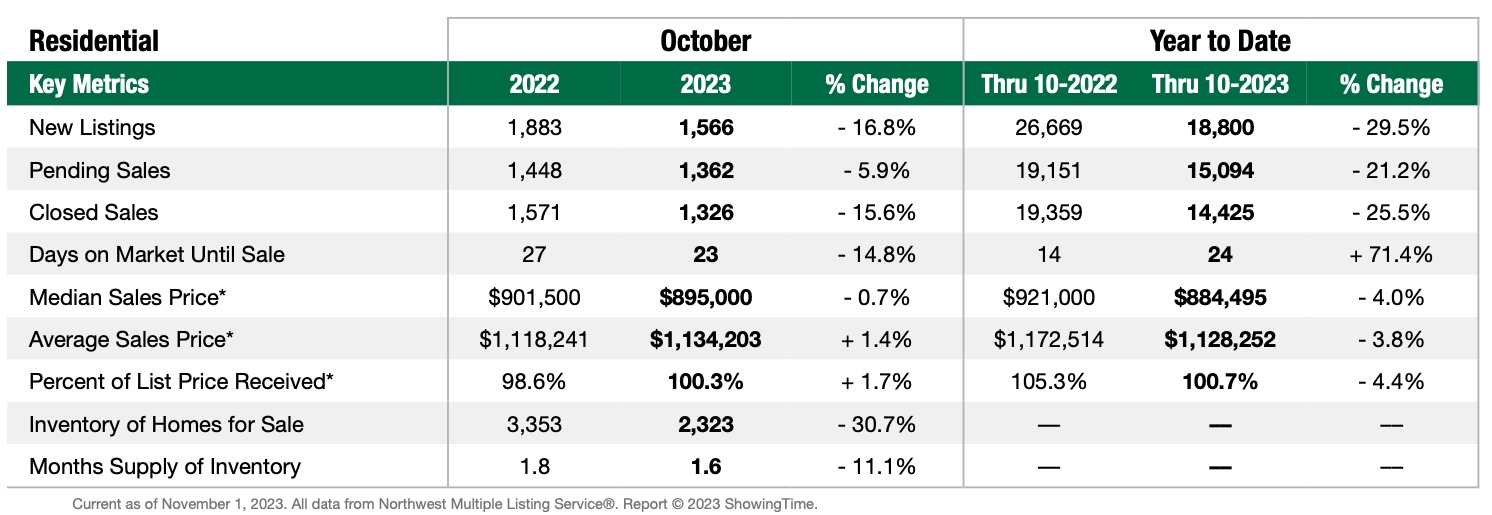

Residential Real Estate Sales

The average sale price for residences in King County during October 2023 reached $1,134K, edging up slightly by +1.4% compared to $1,118K in October 2022. This positive change underscores how, despite the continued rise in interest rates (discussed below), demand for residences remains strong in the region.

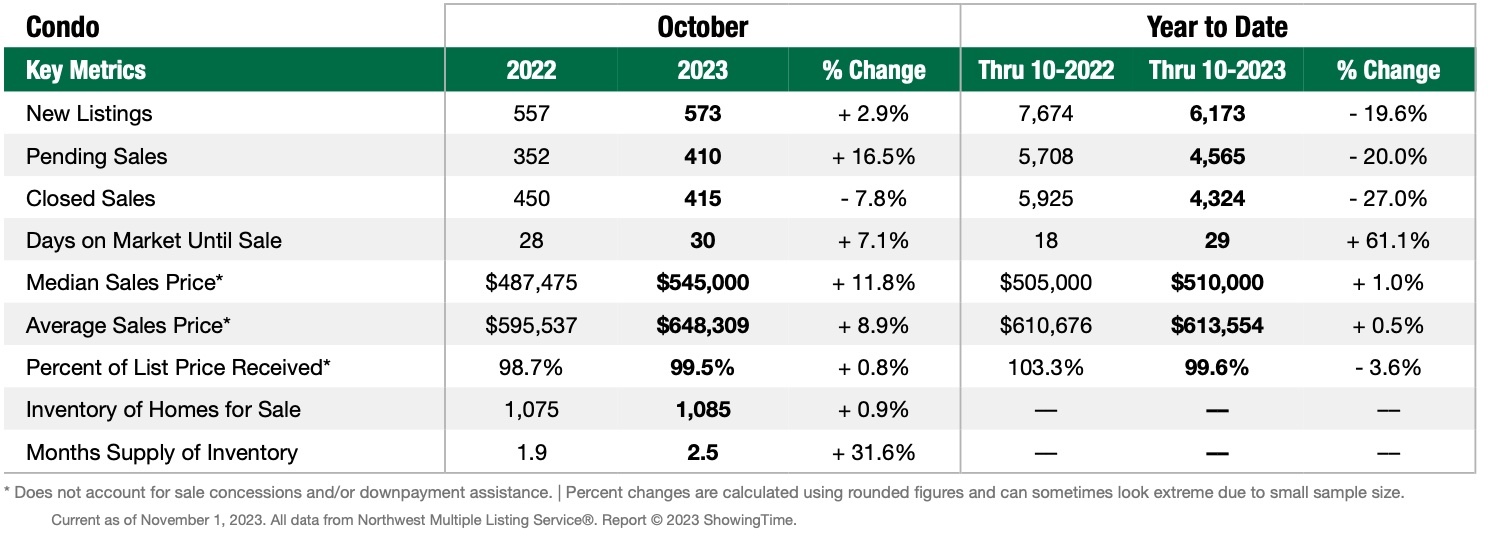

Condo Market Sales

Condominiums experienced a substantial surge in year-over-year sale prices in October 2023. The recorded average of $648K represents an impressive increase of +8.9% from the October 2022 figure of $596K. This surge in condo values may be due to many switching from higher-cost residences, though evolving lifestyle preferences and other factors may be at play as well.

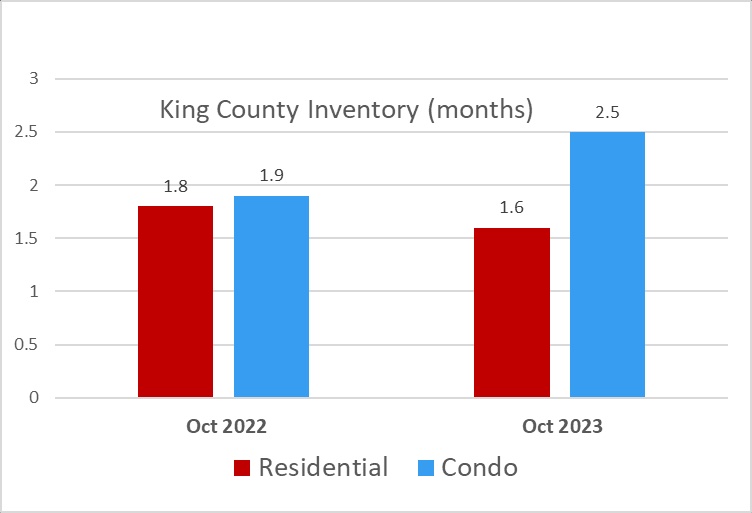

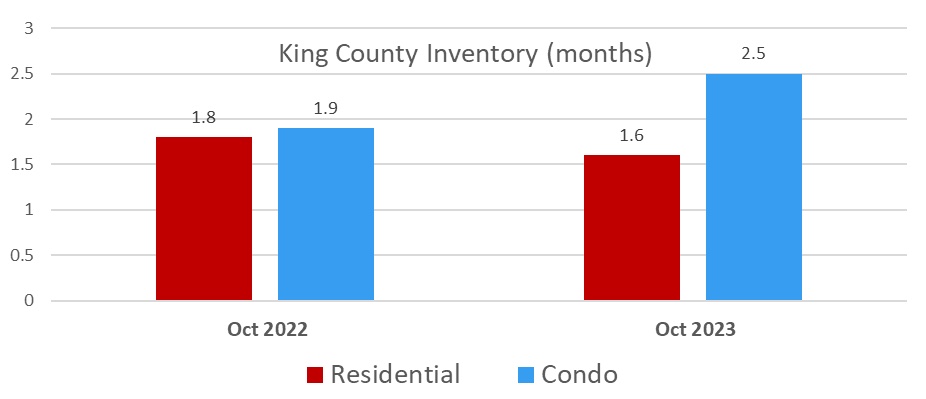

Inventory

The strong demand for housing continues to impact King County’s real estate landscape. The consistent demand for housing with a limited supply of homes exerts upward pressure on prices. Notably, residential inventory decreased 11.1%, dropping from 1.8 in October 2022 to 1.6 in October 2023, reflecting the heightened competitiveness in the market. Conversely, the condo market saw a significant increase of 31.6% in inventory, rising from 1.9 in October 2022 to 2.5 in October 2023.

Mortgage Rates

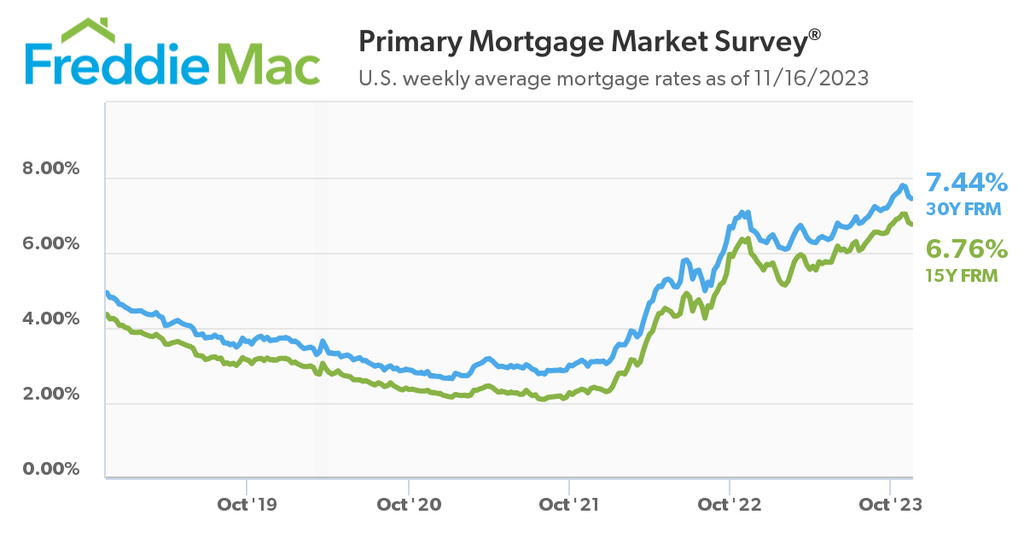

As shown in the Freddie Mac graph below, interest rates have taken a dip, though that dip actually occurred in November. The high point in the graph represents the end of October at 7.79% for a 30-year mortgage and 7.03% for a 15-year mortgage. Freddie Mac projects slower economic growth and lower inflation in 2024, but not so much as to significantly reduce mortgage rates (“Economic, Housing and Mortgage Market Outlook – October 2023”).

Should mortgage rates fall, it is expected that more buyers will come onto the market since lower mortgage rates correspond to more buying power for those getting a home mortgage. This should in turn cause upward price pressure. Once mortgage rates drop to a level that homeowners with historically low mortgages feel they can move, the inventory level should increase, but at least until that time, the seller’s market is expected to continue.

Conclusion

As the figures above show, housing prices in King County are still rising, demonstrating a resilient real estate market. While the housing market is generally expected to loosen up in 2024 with slightly lower interest rates, no dramatic change in supply and demand appears to be on the horizon.

Keeping an eye on the trends in real estate and mortgage rates is key for making informed decisions in the real estate market.

This market report is brought to you by Russell Jones Real Estate.