The Seattle Seller’s Market

In any year, the real estate market sees fluctuations based on multiple factors that include the supply-and-demand balance, the unemployment rate and the general economy; this year, the coronavirus pandemic unexpectedly caused economic interruptions, leading to job losses, income reduction and uncertainty about the future. How has this affected the real estate market in Seattle?

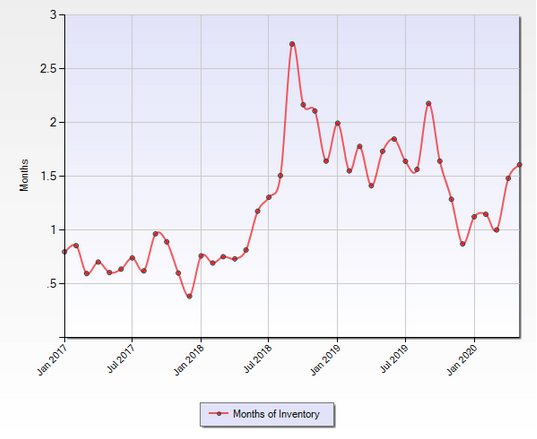

For years, the residential real estate market in the Puget Sound has been a seller’s market (in favor of the seller). A balanced real estate market is generally defined as having about six months of inventory (homes) available, where six months of inventory means it would take about six months for all of the listed homes to sell at the current sales rate. As the pandemic came on this year, it seemed initially that economic difficulties would cause a reduction in buyers, slowing demand and making the market more favorable to the buyer.

However, as the above graph shows, the number of months of inventory has in fact decreased in 2020 compared to the same months in 2019, making the market tilt even further in favor of the seller. It seems that this reduction in months of inventory must come from potential sellers holding off (perhaps due to concerns about finding a new home), lowering the number of listings coming onto the market. This is illustrated by the following graph:

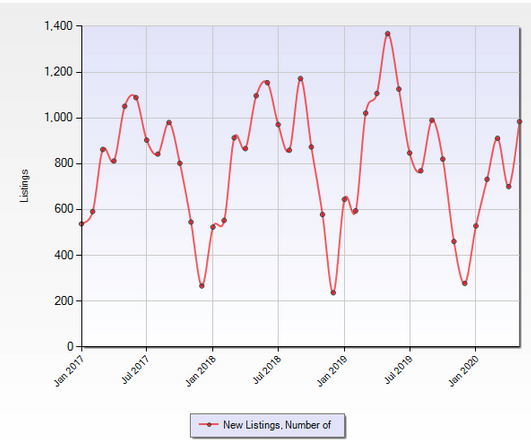

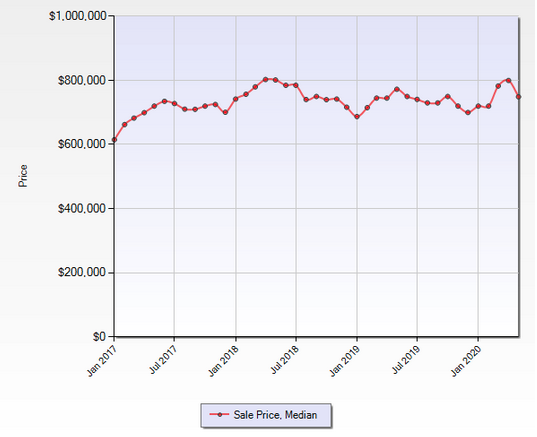

The graph shows that fewer homes have come onto the market this year than in 2019. Given that the supply-and-demand balance remains in the favor of the seller and that fewer homes are being listed, prices should remain strong. (Concerning the Western Washington real estate market, Mike Larson, director of the Northwest Multiple Listing Service, said, “The market has proved to be very resilient.“) The median price trend for sales in Seattle is shown in the following graph:

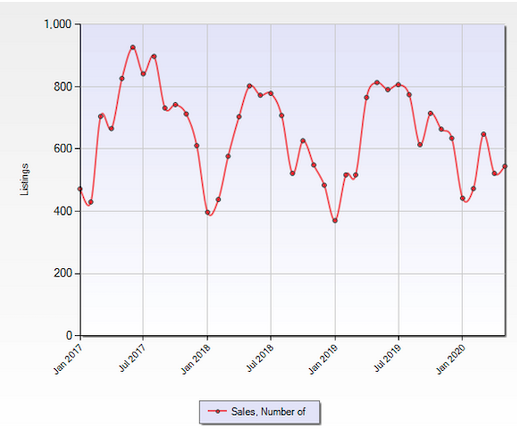

A rise in price is indeed what is shown, though there was a dip between April and May. Whether this is a mere statistical blip or the beginning of a price downturn cannot yet be determined. We look next at the volume of sales (number of transactions) in Seattle:

Clearly, the sales volume lags behind 2019, supporting the idea that we are seeing hesitancy on the part of both buyers and sellers. As with the median price, May shows a small reversal compared to April, which again may be a statistical blip or an uptick beginning a new trend.

On June 5th, King County began reopening the economy as phase 1.5 in the pandemic Safe Start program. This phase is similar to phase 2 but differs mostly by allowing fewer people in spaces and 30-minute time limits for certain activities, including indoor real estate activities.

With no vaccination yet available for COVID-19 and infections on the rise in some areas, the future of the economy and real estate is even less predictable than usual. Let us hope that a cure or vaccine against the coronavirus will soon be developed, and in the meantime please keep washing those hands and wearing those masks!

Please note that this article refers exclusively to residential real estate in Seattle. This article is an opinion of the writer and should not be considered financial advice. Always consult a real estate professional before investing or divesting in real estate.

Further reading:

- See Hot, Cold, and Neutral Real Estate Markets to learn more about seller’s markets, buyer’s markets and neutral markets.

- Read “New home listings, pending sales up in Seattle month over month amid pandemic” in the Seattle PI.

- Read the June press release from the Northwest Multiple Listing Service.

- The Seattle PI has an article on how to time the market during the pandemic (spoiler: when it’s best for you)

- See also an article in Forbes on cities with recovering real estate market: “A Booming Housing Market: Real Estate In These Cities Is Quickly Recovering.”

Copyright notice for graphs and data provided therein: Information and statistics compiled and reported by the Northwest Multiple Listing Service