King County Real Estate Market Report

December 2023

Summary

Real estate prices in the King County market continued to grow in December 2023, rising 10% for residential homes year-over-year and 15.5% for condominiums. This growth is due to low inventory and a relaxation of lending rates. In this report, we look at key statistics of the King County real estate market.

Average Sales Price

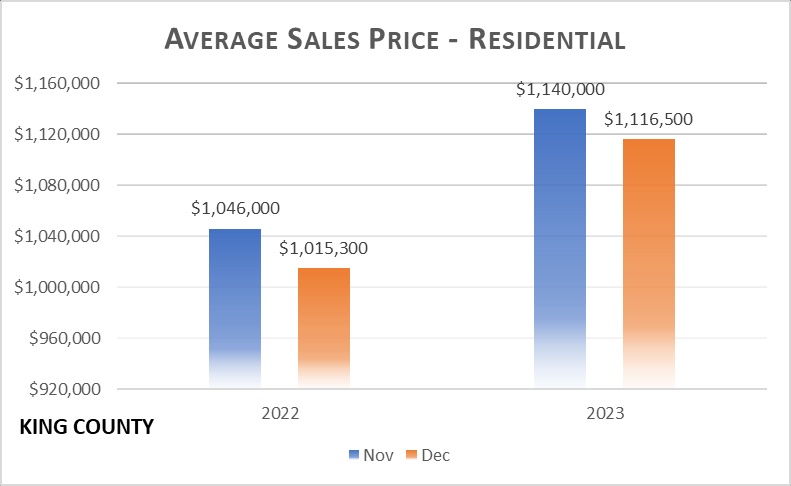

The average (mean) residential sales price is the most important indicator of real estate. As shown in the graph below, the average sales price rose year-over-year from the end of 2022 to 2023 in the King County real estate market. In particular, the average sales price jumped 10.0% from December 2022 ($1.015M) to December 2023 ($1.117M).

Comparing November 2023 to December 2023, we see there was a drop of 2.1% from $1.140M to $1.117M. However, that same drop occurred the previous year ($1.046M to $1.015M, or 2.9%). Thus, it appears the reduction from November to December is merely seasonal, while the year-over-year increase is more reflective of the King County real estate market overall.

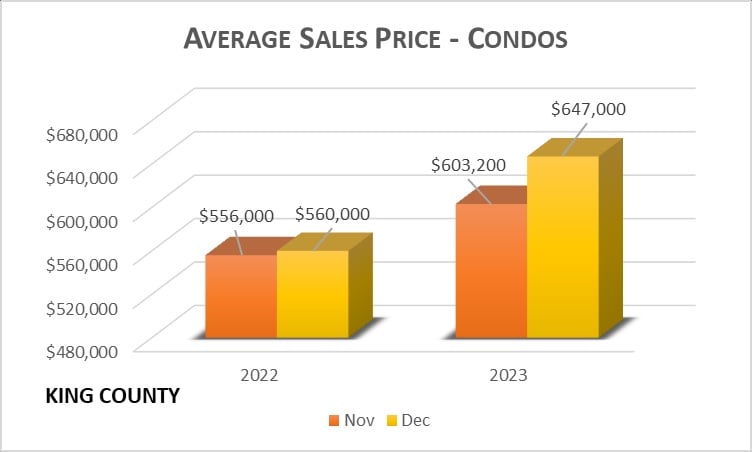

The numbers for condominiums in King County tell a similar story but with higher percentages. As shown in the graph below, the average sales price for condos skyrocketed from $560K in December 2022 to $647K in December 2023, a 15.5% increase. That’s 55% greater than the increase in the residential market.

Looking at the difference between November and December, the average condo price for condominiums rose from $603K to $647K in 2023. This represents a 7.3% increase, unlike the slight drop seen in residences for this time period.

In addition to the tight conditions that effect the residential market, upward price pressure likely bears on the condo market due to people switching from residences to condos for affordability.

Months of Inventory

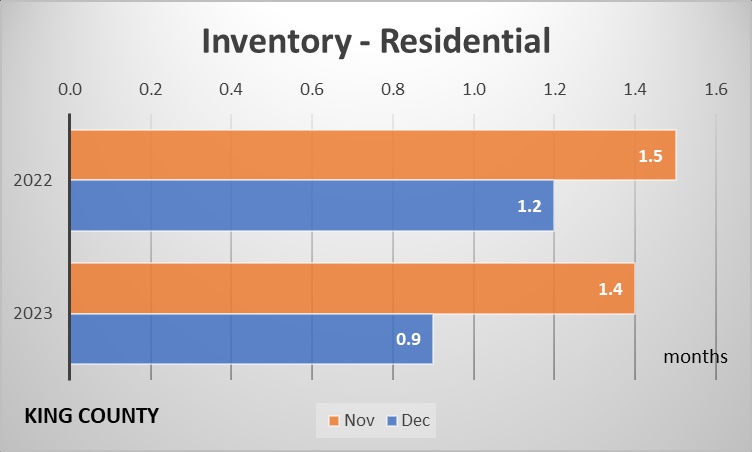

In real estate, the “months of inventory” statistic refers to how long it will take at the current rate of sales to sell all of the homes currently on the market. This is considered a key indicator of how strong the market favors buyers or sellers. In general, 0 to 3 months of inventory is considered a seller’s market, 4 to 6 a balanced market, and 7 to 9 a buyer’s market. In recent years, King County has maintained a low inventory of housing, which tends to push prices upward because demand outstrips supply.

The inventory dropped significantly from November to December for both residences and condominiums. It dropped as well year-over-year for residential homes, though there was an increase in condominium inventory year-over-year. Here are the figures for residential inventory in King County:

As the graph shows, there was a drop between November and December both in 2022 and 2023. The percentages are 26.5% and 35.9%, respectively. Year-over-year as well, inventory dropped from 2022 to 2023. The decrease from 1.2 months in December 2022 to 0.9 months in December 2023 is 39.3%. With less than one month of inventory in December, the housing supply was at an extremely low level.

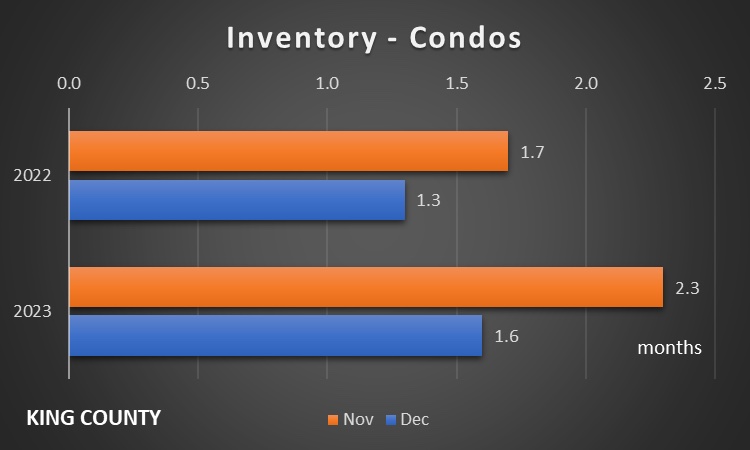

We see next that for condominiums, the inventory has actually grown over the past year, though the numbers still keep market firmly in the seller’s market category.

As we see, there was a drop from November to December in both 2022 and 2023. Year-over-year, however, the inventory has grown. Like the residential market, the condo market remains a strong seller’s market in King County.

Other Market Indicators

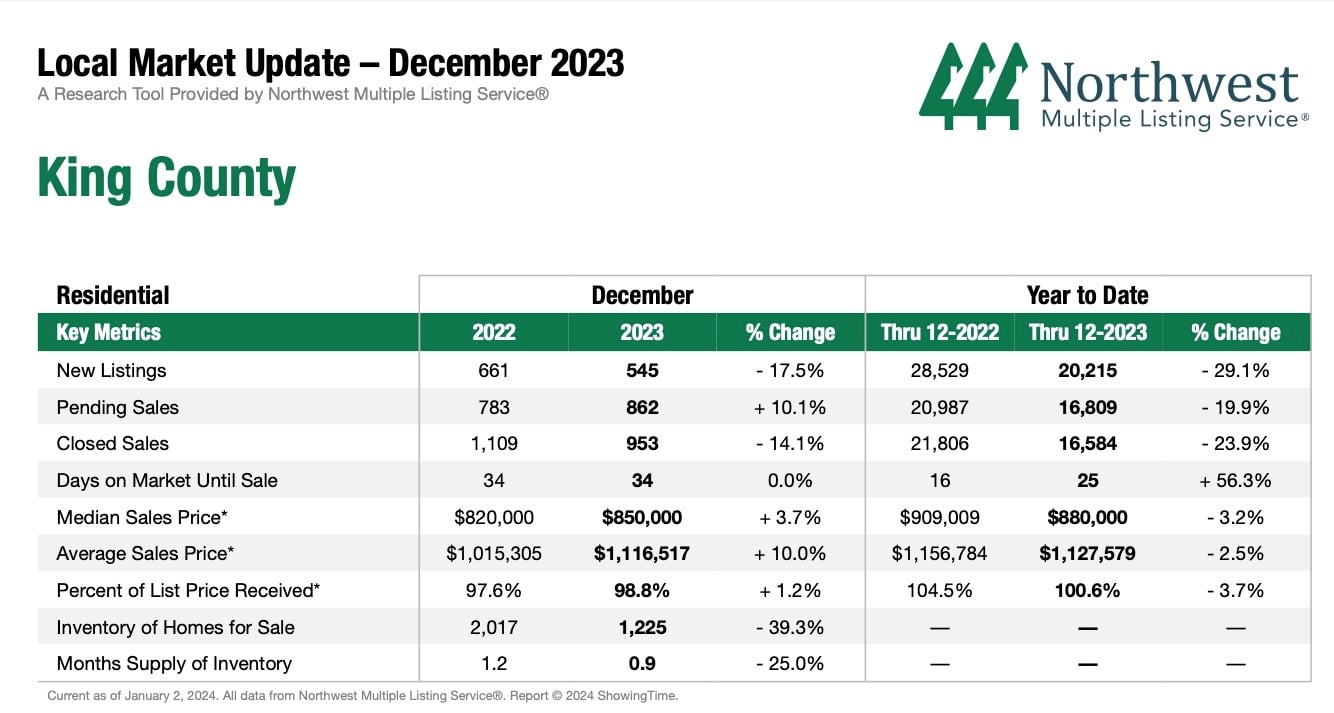

The table below shows several other indicators for residential homes in King County in December 2022 and 2023, as well as year to date statistics.

Comparing December 2022 and December 2023, we see in the table that there was a 10.1% jump in pending sales while new listings plummeted 17.5% and closed sales dropped 14.1%. These numbers indicate that homeowners are not selling, which is confirmed by the last two rows, which show dramatic drops in inventory levels.

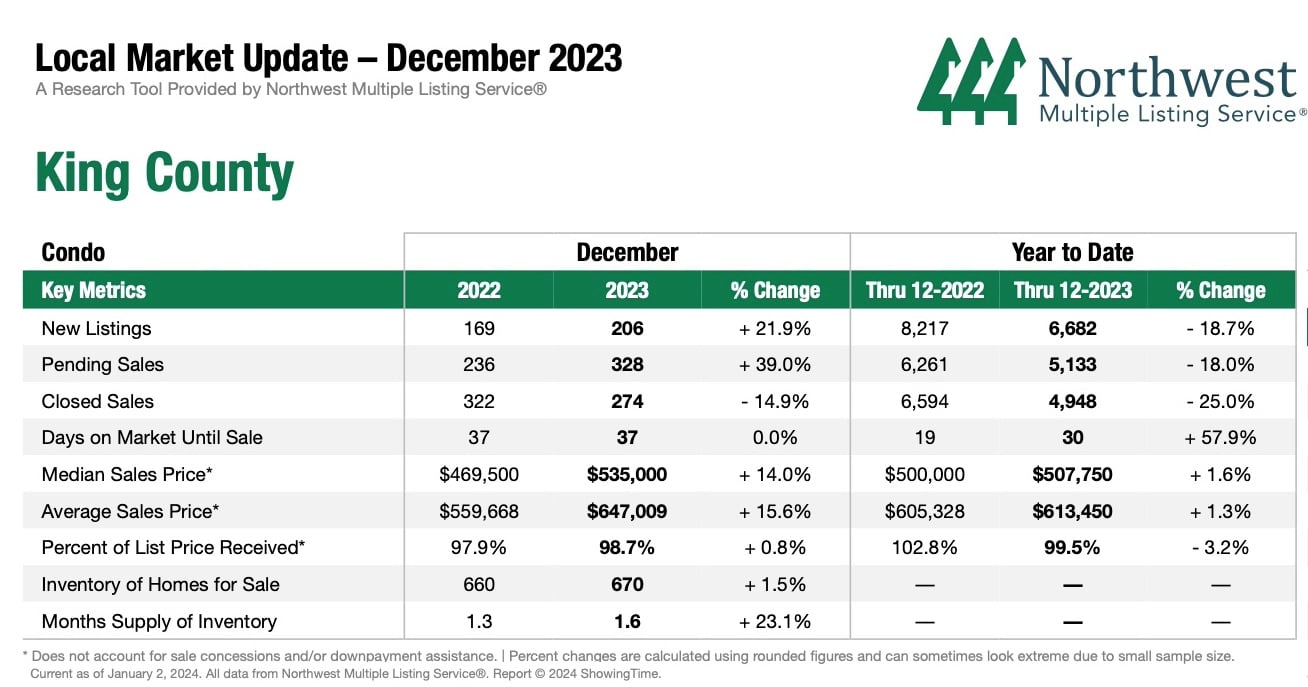

Next we look at condominiums.

In the table, we see higher pending sales and lower closed sales, but there are also more new listings. As we saw above with the higher inventory levels, it seems that condominium owners are more willing to sell than residential homeowners.

Conclusion

Since before the pandemic, the King County real estate market has been a strong seller’s market. During the pandemic, prices skyrocketed as supply grew scarce and mortgage rates dropped. (For mortgage rate analysis, see the RJRE King County Real Estate Report for November and the Freddie Mac website.) With mortgage rates much higher last year, homeowners with low-interest mortgages are not interested in moving as doing so means contending with a higher interest rate on a new mortgage.

Mortgage rates appear to have turned around and the Federal Reserve Board has indicated they will likely drop the lending rate three times this year. If mortgage rates continue to drop as a result, homeowners may be more likely to sell, loosening up the market for buyers. In the meantime, it appears that King County real estate will continue to appreciate in value as buyers scramble to find properties to buy.