King County Real Estate Report for November 2023

The real estate market in King County remained tight, as expected, in November 2023. However, there appears to be some loosening in continuation from October in light of certain statistics. Of particular note is the uptick in certain numbers such as condominium inventory year-over-year. While this may be tied to the downward inching of mortgage rates, the same year-over-year inventory increase was seen in condominiums last month without such a mortgage rate drop.

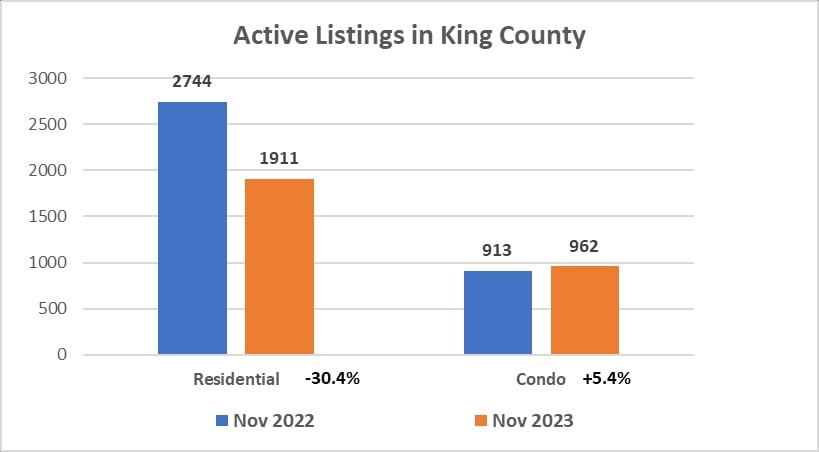

Active Listings

As in October, the number of available listings in King County dropped overall, though when broken out by type, the number of condominiums available actually increased slightly by 5.4% while residences plunged 30.4% as illustrated in the graph above. This continues a general trend seen last month (see King County Report — October 2023) in which the number of available residences dropped 30.7% compared to the previous year and the number of available condominiums increased 0.9%.

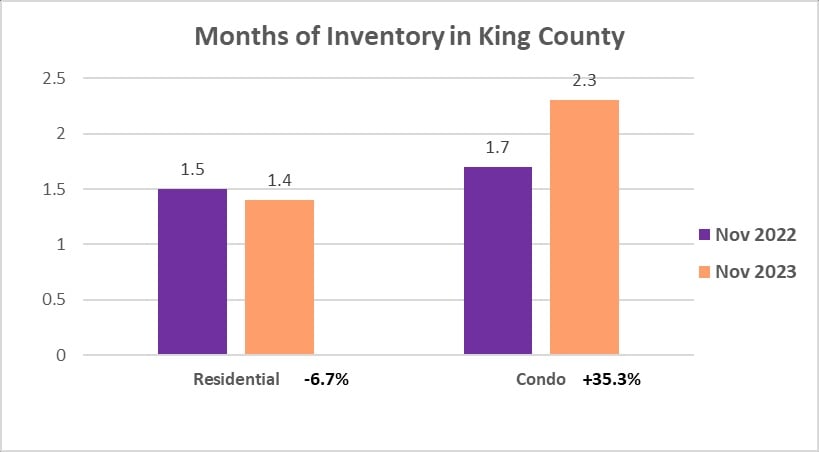

Months of Inventory

While related to active listings, months of inventory indicates how many months it would take to sell all the listed homes at the current rate of sales. Months of inventory is an important indicator of buyer and seller sentiment. In the real estate industry, 0 to 3 months of inventory is considered favorable to the seller (a “seller’s market”), 4 to 6 months is considered balanced, and 7 months or more is considered to be favorable to the buyer (a “buyer’s market”).

As shown in the graph above, there was a decrease in residential inventory between November 2022 and November 2023 but an increase in condominium inventory. As per the October report (see King County Report — October 2023), the numbers were -11.1% and +31.6%, respectively, last month. Thus we see ongoing trends where the residential market appears to be tightening and the condominium market to be loosening up.

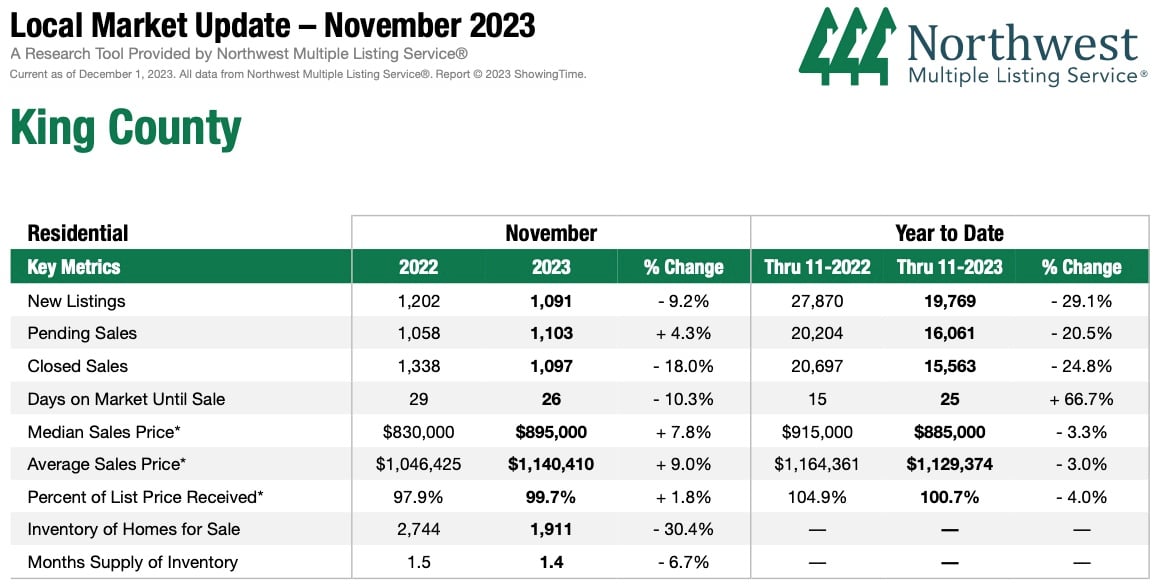

Residential Report

Let’s now take a look at the November 2023 statistics for residences in King County.

November 2022 vs November 2023

As seen in the table above, fewer homes (“new listings”) came on the market in King County in November 2023 than 2022. This continues the trend seen last month. At the same time, there was an uptick in pending sales, a reversal of last month. Closed sales dropped significantly in November, just as they did in October. Because there is a lag between a home going pending (agreement to purchase) and a closure (purchase complete), the pending uptick may portend a positive reversal in closed sales for December.

Both the median and average sales prices showed large year-over-year increases. This is in contrast to October’s numbers which were -0.7% and +1.4%, respectively. The reduced inventory to 1.4 months means there simply aren’t enough listings to satisfy buyers, which maintains that strong imbalance between supply (low) and demand. Given the acute lack of supply of homes, it seems that prices will continue to move upward unless some dramatic economic event disrupts the market.

Year to Date

In 2023 to date, the number of new listings plunged 29.1%, meaning residences did not come on the market to replace sold homes as compared to last year. A drop in supply should drive up prices, but the demand dropped with 20–25% fewer pending and closed sales, probably due to high mortgage rates. This drop in demand balanced out the drop in listings, resulting in little change in prices.

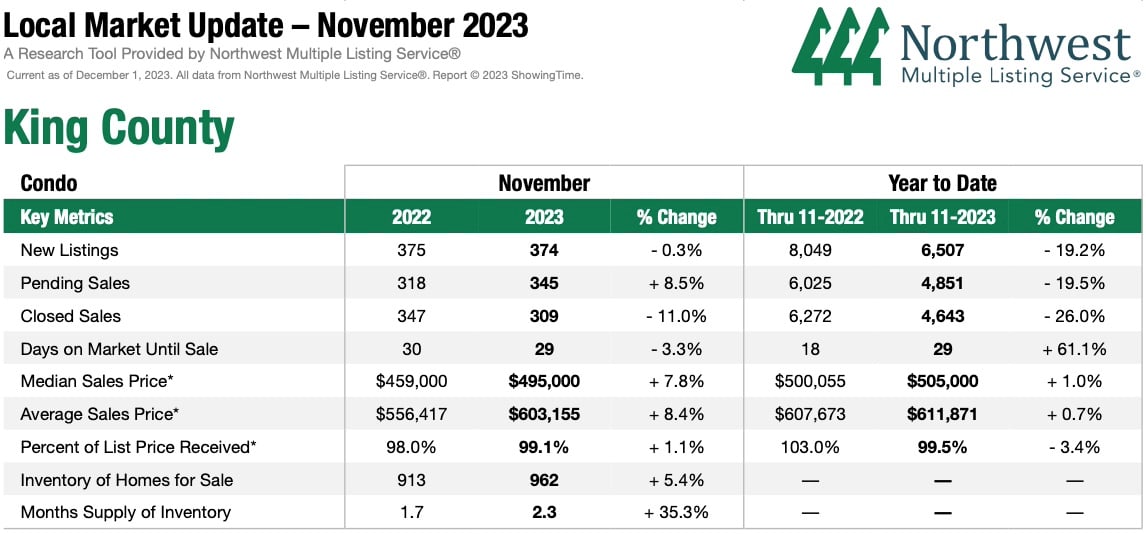

Condominium Report

Next we turn to the November 2023 statistics for King County condominiums.

November 2022 vs November 2023

Listings and sales volume are a mixed bag. While new listings are essentially unchanged for King County condominiums year-over-year, there was a jump in pending sales and a significant drop in closed sales. The pending sales and closed sales show similar trends to residences. As with residences, this jump in pending sales may point toward increased closed sales in December.

Both median sales and average sales are up, around 8% each, a sign that there is strong upward pressure on prices. While months supply of inventory soared 35.3%, it remains at 2.3 months, well within the boundaries of a seller’s market.

Year to Date

In 2023 to date, the number of new condominium listings sank 19.2%, about 10% shy of residences. As with residences, demand (pending and closed sales) also dropped, keeping prices in balance overall.

Mortgage Rates

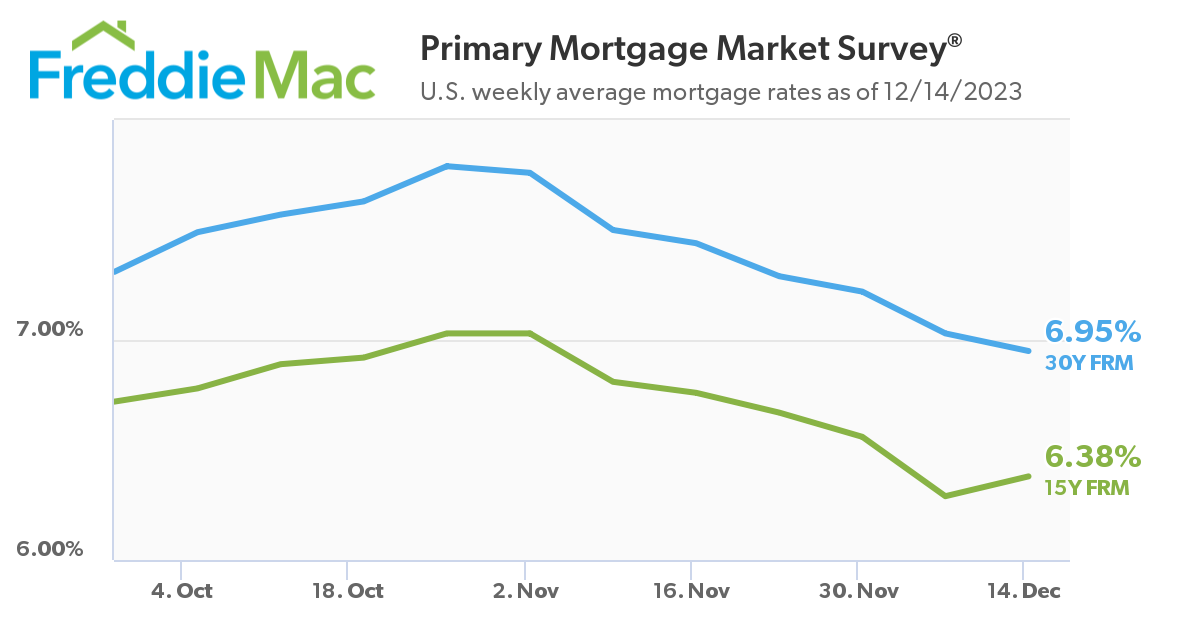

In November, mortgage rates came down as shown in the graph above. In the illustration, the blue (upper) line represents 30-year mortgage rates, and the green (lower) line represents 15-year mortgage rates. According to Freddie Mac, mortgage rates peaked this year on or about October 26 at 7.79% (30-year) and 7.03% (15-year). Since then, mortgage rates have steadily fallen, reaching 6.95% (30-year) and 6.38% (15-year) on December 14th.

Of particular note, the Federal Reserve Board projected last week that they would lower the federal funds rate (see FRB Economic Projections) over the next three years with a “central tendency” of 2.5–3.3% over the longer run. While indirect, this federal funds rate has impacts mortgage rates. It is expected that the FRB’s announcement as well as the projected rate reductions will loosen the housing market.

Analysis

While mortgage rates were at historical lows in the early 2020s, most new homeowners locked in those low interest rates and many existing homeowners refinanced to obtain those lower rates. If a homeowner with such a low rate moves and purchases a new home, they face an immense hike in the mortgage interest rate. This greatly reduces their buying power and, of course, paying more for interest is not a pleasant prospect in general.

Shedding the Golden Handcuffs

These homeowners are thus caught in “golden handcuffs” such that even if they want to move, they are loathe to make the payments on a mortgage with a much higher rate. If mortgage rates continue to fall, which should happen given the FRB’s projections, those homeowners will be more likely to move and leave their golden handcuff mortgage behind. As rates fall, the market should thus loosen up with more inventory on the market.

Caveat

However, the tight market over the past few years likely has created a strong pent-up demand. That demand includes people who want to buy but cannot afford the house payment because of the current high mortgage rates and people who are simply unable to find a home because of the paucity of inventory. Therefore any increase in inventory as homeowners sell may in fact be rapidly consumed so that the market remains in the seller’s column.

For now, some buyers are taking the plunge when they find a home they like with the idea of refinancing when rates drop. Refinancing does incur charges, however. While refinancing charges can sometimes be rolled into the mortgage amount, given a large drop in mortgage rates, it may be worth it. We recommend talking to at least three lending institutions or a expert mortgage broker who can select competitive rates that meet your situation.

This market report is brought to you by Russell Jones Real Estate.

Sources

Except when referencing the Freddie Mac mortgage rate numbers, the data cited in this document and shown in graphs is from Northwest Multiple Listing ServiceⓇ. Note that certain exceptions apply to the data.