Skagit County Real Estate Report for November 2023

The Skagit County real estate market remained tight, as expected, in November 2023. However, there appears to be some loosening in continuation from October in light of certain statistics. Of particular note is the uptick in certain numbers such as condominium inventory year-over-year. While this may be tied to the downward inching of mortgage rates, the same year-over-year inventory increase was seen in condominiums last month without such a mortgage rate drop.

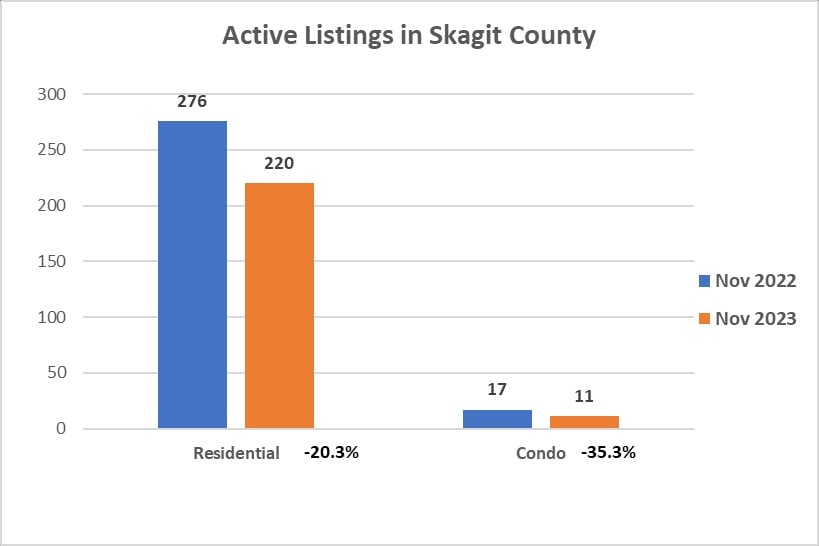

Active Listings

As in October, the number of available listings in Skagit County dropped year-over-year as seen in the graph above. Nevertheless, these numbers are slightly higher than October, where there were 238 available residences and 12 available condominiums. See Skagit County Report — October 2023.

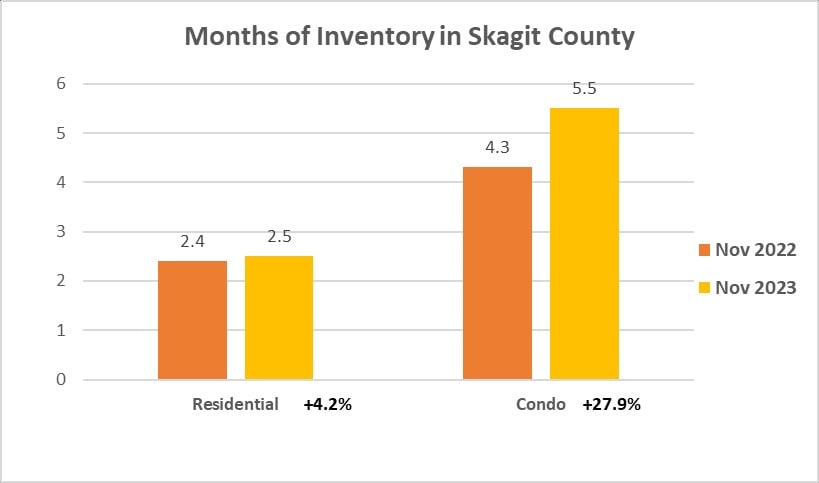

Months of Inventory

While related to active listings, months of inventory indicates how many months it would take to sell all of the available homes at the current rate of sales. This statistic is an important indicator of how strongly tilted the market is toward buyers (because of weak demand) or toward sellers (because of strong demand). In the real estate industry, 0 to 3 months of inventory is considered favorable to the seller (a “seller’s market”), 4 to 6 months is considered balanced, and 7 months or more is considered to be favorable to the buyer (a “buyer’s market”).

The graph above shows a slight year-over-year increase from 2.4 to 2.5 months of residential inventory in Skagit County. Nevertheless, the Skagit County real estate market remains firmly a seller’s market for residences. In contrast, the condominium inventory jumped 27.9% year-over-year, pushing Skagit County condominiums into a balanced market (but see the Condominium Report below).

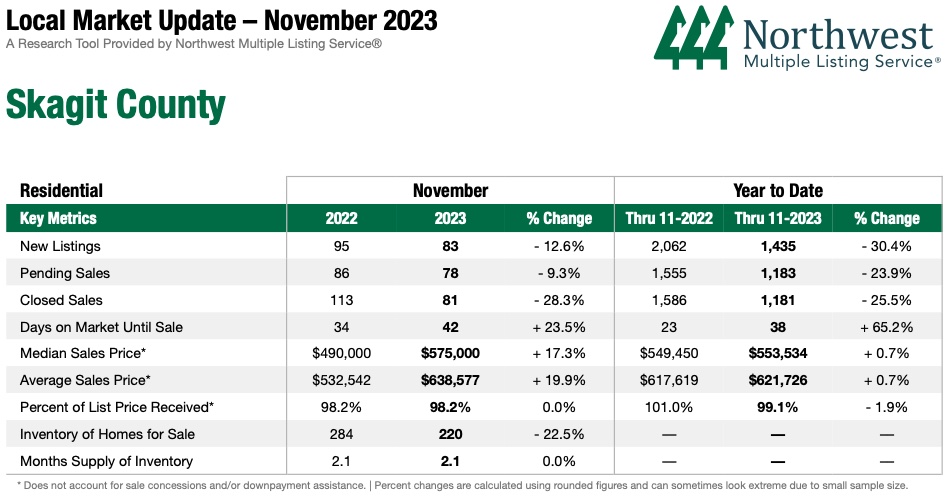

Residential Report

Let’s now take a look at the November 2023 statistics for residences in Skagit County. Note that the statistics here differ slightly from the statistics in the graphs above.

November 2022 vs November 2023

As seen in the table above, fewer homes (“new listings”) came on the market in Skagit County in November 2023 than 2022. This continues the trend seen last month. Also following October, pending and closed sales both dropped significantly compared to November 2022. Not only was sales volume thus down, but the time on the market shot upward by nearly one-fourth. An important caveat to this statistic is that this is the mean average, which can be affected greatly by outlier data. Although not shown in the table, the median days on market was 23 for November, a jump of 10 days compared to October, and a jump of 4 days (21.1%) compared to November 2022.

The drop in sales and increase in days on the market indicate a cooling off. This generally means prices will go down because buyer demand is less.

However, sales prices leaped tremendously, reaching a median of $575K and a mean average of $639K. That is because inventory is down, resulting in simply a slow-down in sales volume that is not translating to lower prices.

Year to Date

In 2023 to date, the number of new listings plummeted 30.4%, which mirrors what happened in November. A drop in supply should drive up prices, but the demand dropped with 20–25% fewer pending and closed sales, probably due to high mortgage rates. This drop in demand balanced out the drop in listings, resulting in little change in prices overall for the year.

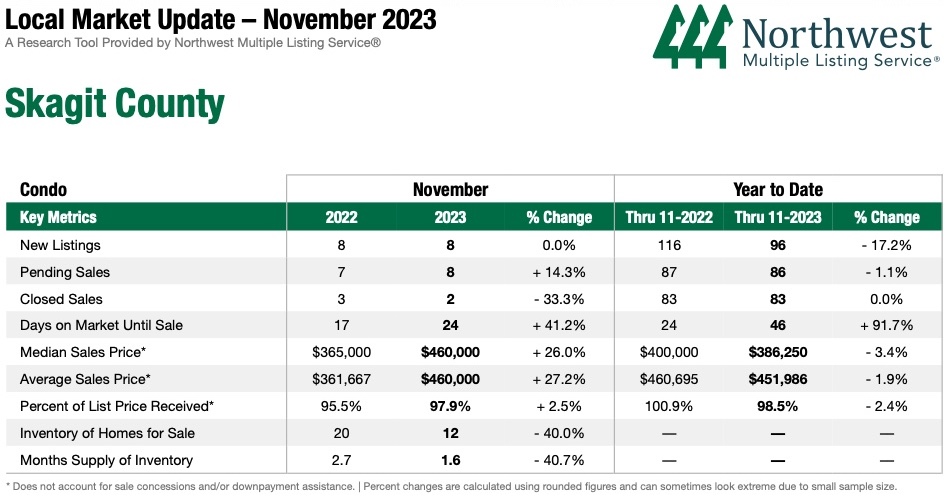

Condominium Report

Next we turn to the November 2023 statistics for condominiums in the Skagit County real estate market. Note that the statistics here differ slightly from the statistics in the graphs at top.

November 2022 vs November 2023

The number of condominiums that came on the Skagit County real estate market in November 2023 was unchanged at 8 from November 2022. While pending sales (+14.3%) and closed sales (-33.3%) changed dramatically in terms of percentage, that was only because the actual volume was so low. The change in volume was merely one fewer pending sale and one fewer closed sale.

While the days on the market jumped 41.2%, this was an increase of 7 days, which is not likely an important indicator given the extremes of the condominium market. Also, the days on market numbers in the table represent mean averages. The median averages were 82 in November 2023 and 13 in November 2022.

Both median sales and average sales prices are up, just over 25% each, a sign that there is strong upward pressure on prices. The days on market, whether mean or median, seem to indicate that the condominium market remains tight.

The months supply of inventory is a mere 1.6, which is a strong seller’s market. This, however, contradicts the figure of 5.5 months given at the top of the article, which is from a more stable source of data. Regardless, the scarcity of inventory means that statistics fluctuate easily. Because of the rise in prices, it appears that the Skagit County real estate market is a seller’s market for condominiums as well as for residences.

December’s numbers may give us more clarity on this issue.

Year to Date

In 2023 to date, the number of new condominium listings dropped 17.2%, about 13% lower than the drop seen in residences. Fewer listings puts upward pressure on prices. However, demand (pending and closed sales) remained essentially unchanged compared to 2022 and days on market nearly doubled. These factors kept prices in check overall for condominiums on the Skagit County real estate market.

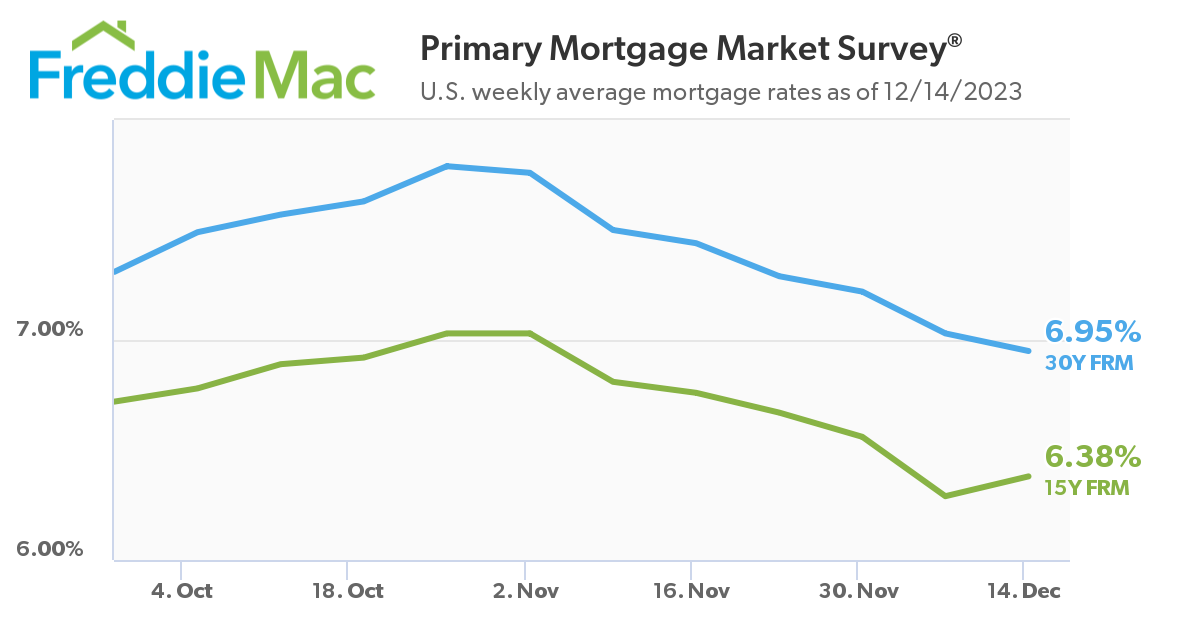

Mortgage Rates

Mortgage rates decreased a bit in November as shown in the graph above. The blue (upper) line in the graph represents 30-year mortgage rates, and the green (lower) line represents 15-year mortgage rates. According to Freddie Mac, mortgage rates peaked in 2023 about October 26 when they were 7.79% for 30-year mortgages and 7.03% for 15-year mortgages. Since then, mortgage rates have steadily fallen, reaching 6.95% (30-year) and 6.38% (15-year) on December 14th.

The Federal Reserve Board projected last week that they would lower the federal funds rate (see FRB Economic Projections) over the next three years. Their target is a “central tendency” of 2.5–3.3% over the longer run. While indirect, this federal funds rate has impacts mortgage rates. If this projection comes to fruition, it should have a great impact on the real estate market.

Analysis

In the early 2020s, mortgage rates were at historical lows. Most new homeowners locked in those low interest rates and many existing homeowners refinanced to obtain those lower rates. If a homeowner with such a low rate moves today and purchases a new home, they face an immense hike in the mortgage interest rate. This greatly reduces their buying power and, of course, paying more for interest is not a pleasant prospect in general.

Shedding the Golden Handcuffs

These homeowners are thus caught in “golden handcuffs” such that even if they want to move, they do not want to wind up with a mortgage requiring payments hundreds of dollars higher. If mortgage rates continue to fall, which should happen given the FRB’s projections, those homeowners will be more likely to move and leave their golden handcuff mortgage behind. As rates fall, the market should thus loosen up with more inventory on the market.

Possible Caveat

The tight market over the past few years has created a strong pent-up demand for housing. That demand includes people who want to buy but cannot afford the house payment because of the current high mortgage rates and people who are simply unable to find a home because of the paucity of inventory. Therefore even if homeowners began selling in greater volume, those homes might be consumed so rapidly that the market remains in the seller’s column.

For now, some buyers are taking the plunge when they find a home they like with the idea of refinancing when rates drop. Refinancing does incur charges, however. While refinancing charges can sometimes be rolled into the mortgage amount, given a large drop in mortgage rates, it may be worth it. We recommend talking to at least three lending institutions or a expert mortgage broker who can select competitive rates that meet your situation.

Conclusion

The Skagit County real estate market remains a seller’s market for residences and probably a seller’s market for condominiums. Sales volume is low as homeowners remain off the market because of the prospect of a higher interest rate with a new home. Even though many potential buyers are also waiting for lower interest rates, enough are buying (with the hopes of refinancing at a lower rate lower) to maintain upward pressure on prices. In December, the Federal Reserve Board announced that interest rates would probably come down next year. We may find that the prospect of lower interest rates is enough to motivate sellers and buyers.

The Skagit County real estate market as well as real estate in the US in general is in unprecedented territory. We will have to wait and see how things evolve from here!

This market report is brought to you by Russell Jones Real Estate.

Sources

Except when referencing the Freddie Mac mortgage rate numbers, the data cited in this document and shown in graphs is from Northwest Multiple Listing ServiceⓇ. Note that certain exceptions apply to the data.